We hope you will consider supporting Highmark Mann through the EITC Program this tax season!

Did you know? In addition to your annual contribution to Highmark Mann, you can redirect your Pennsylvania tax payment to support our education programming.

Pennsylvania’s Educational Improvement Tax Credit (“EITC”) program permits donors to redirect 90% of their state income tax liability to an approved Educational Improvement Organization (“EIO”), like Highmark Mann.

*An EIO is a not-for-profit organization registered with the Pennsylvania Department of Community and Economic Development, which provides educational programs, services, and initiatives that improve student achievement in Pennsylvania.

Who can participate in the EITC program?

The EITC program is available to both individuals and businesses.

Eligible donors must:

- Have Pennsylvania-source income.

- Work for, own shares in, be a partner of, or be a member (owning an interest in an LLC) of a business which pays taxes in Pennsylvania.

- Be current on all state and federal tax obligations.

What does the EITC program look like for Highmark Mann?

Highmark Mann Center partners with Friends of Education, which serves as a “pass-through” for EITC funding directed to Highmark Mann. Friends of Education provides a simple and convenient way for individuals and businesses to participate in supporting education through special-purpose entities. By enrolling, donors can redirect a portion of their tax dollars from Harrisburg to Highmark Mann.

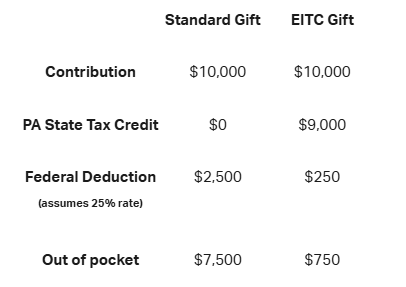

By utilizing the EITC program, it costs very little to donate a lot. The following chart illustrates the highly leveraged tax benefits:

Why should I consider participating in the EITC program?

- Receive a state tax credit of up to 90% of your contribution.

- Receive a 10% itemized charitable deduction on your federal return.

- Directly support Highmark Mann’s mssion to provide leadership in arts education through innovative and high-impact collaborative educational activities for young people throughout the Philadelphia region. 100% of your EITC gift would be redirected to Highmark Mann.

How do I redirect my tax dollars to Highmark Mann through EITC?

Donors join a special purpose entity (“SPE”), which is a partnership. Donors join the SPE by executing a joinder agreement. Once enrolled, donors remit a payment to the designated SPE. Friends of Education will give 100% of the gift to the Mann Center.

You must make a minimum contribution of at least $5,000 in 2025 and $5,000 in 2026. To maximize the leveraged nature of the program, individuals and businesses should participate in an amount equal to 110% of their Pennsylvania tax liability. This program is based on the applicant’s Pennsylvania tax liability (or joint tax liability), not income; therefore, each taxpayer’s situation will differ. Pennsylvania tax liability is reported on Form PA-40 Line 12. These credits are not refundable. That means if a donor gives more than 110% of its state tax liability, the donor will not receive a state tax benefit for any amount that exceeds the 110% threshold. Donors should consult a tax professional prior to participating.

Next Steps

- Speak with your tax advisor to determine whether you are eligible to participate.

- Notify Damaris South, Head of Major Gifts and Planned Giving that you intend to contribute EITC funds at DSouth@HighmarkMann.org or 215-546-7900 Ext. 103.

- Request and return a joinder agreement form through Info@PATaxCredits.org.

- Make your donation to the SPE designated in the joinder agreement.

- Claim your tax credit and federal deduction on your 2024 tax return.